| Table of Contents |

| 1. Understanding Business Budgeting Fundamentals |

| 2. Key Benefits of Strategic Financial Budgeting |

| 3. Five Effective Business Budgeting Methods |

| 4. Step-by-Step Guide to Creating a Financial Business Budget |

| 5. Financial Business Budgeting Templates You Can Use |

| 6. Financial Analysis Example: Budget Implementation Case Study |

| 7. Best Tools for Financial Business Planning |

| 8. How to Track Financial Business Performance |

| 9. Managing Financial Business Risks Through Budgeting |

| 10. FAQs About Financial Business Budgeting Strategies |

Understanding Business Budgeting Fundamentals

A business budget is a detailed financial plan that outlines expected income and expenditures over a specific period, typically 12 months. It serves as the financial foundation for all business activities and provides a framework for making informed decisions about resource allocation.

The Core Components of a Business Budget

Revenue Projections

Forecasting expected income from all sources based on historical data, market conditions, and growth plans. Accurate revenue projections are essential for realistic budgeting and typically include:

- Sales forecasts by product/service line

- Recurring revenue streams

- Seasonal fluctuations

- New market or product launches

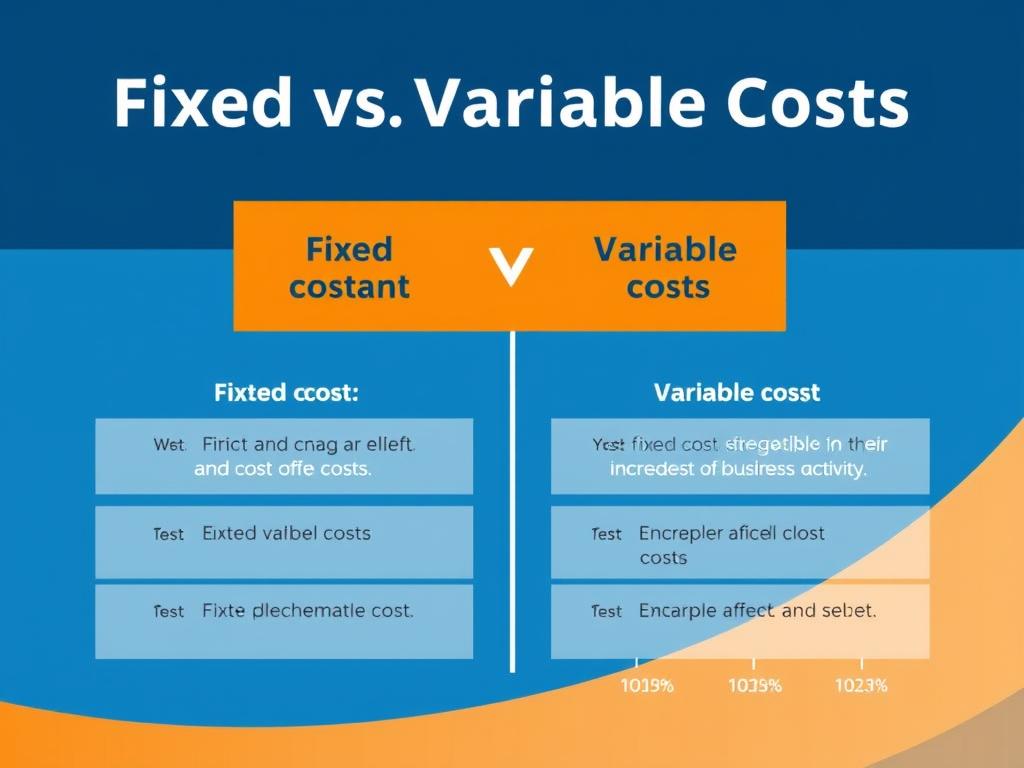

Expense Categories

Categorizing all anticipated costs provides clarity on spending patterns and helps identify areas for potential savings. Key expense categories include:

- Fixed costs (rent, salaries, insurance)

- Variable costs (materials, commissions, utilities)

- Operating expenses (marketing, travel, supplies)

- Capital expenditures (equipment, technology)

Types of Business Budgets

Operating Budget

Covers day-to-day business operations, including revenue projections and operating expenses. This is the most common type of budget and forms the foundation of financial planning.

Cash Flow Budget

Tracks the timing of cash inflows and outflows to ensure sufficient liquidity for business operations. This helps prevent cash shortages and manage working capital effectively.

Capital Budget

Plans for major investments in long term assets such as equipment, facilities, or technology. Capital budgets typically span multiple years and include ROI analysis.

Key Benefits of Strategic Financial Budgeting

Implementing effective financial business budgeting strategies delivers numerous advantages beyond basic expense tracking. Organizations that master strategic budgeting gain competitive advantages through improved financial discipline and foresight.

Strategic Planning Benefits

- Aligns financial resources with business objectives

- Provides a framework for strategic decision-making

- Enables scenario planning for different market conditions

- Facilitates more accurate financial forecasting techniques

- Creates accountability for financial performance

Operational Benefits

- Improves cash flow management and liquidity

- Identifies inefficiencies and cost-saving opportunities

- Optimizes resource allocation across departments

- Enhances financial business efficiency

- Provides early warning of potential financial issues

Growth Benefits

- Supports financial business growth strategies

- Enables informed investment decisions

- Facilitates access to financing with solid projections

- Creates a foundation for scaling operations

- Builds investor and stakeholder confidence

“A budget is telling your money where to go instead of wondering where it went. For businesses, strategic budgeting is the difference between reactive financial management and proactive financial leadership.”

Five Effective Business Budgeting Methods

Choosing the right budgeting methodology is crucial for implementing successful financial business budgeting strategies. Each approach offers distinct advantages depending on your organization’s size, industry, and financial objectives.

1. Incremental Budgeting

Incremental budgeting uses the previous period’s budget as a baseline, making incremental adjustments for the upcoming period. This approach is straightforward and time efficient, making it popular among established businesses with stable operations.

Advantages

- Simple to implement and understand

- Requires minimal time and resources

- Provides budget stability and predictability

- Works well for businesses with consistent operations

Limitations

- May perpetuate inefficiencies from previous periods

- Doesn’t encourage critical evaluation of expenses

- Can lead to budget padding and unnecessary spending

- Less adaptable to changing business conditions

2. Zero-Based Budgeting (ZBB)

Zero based budgeting starts from a “zero base,” requiring every expense to be justified for each new period. This method forces a thorough evaluation of all spending and aligns resources with strategic priorities.

Advantages

- Eliminates legacy spending and inefficiencies

- Aligns resources with current strategic priorities

- Improves cost awareness across the organization

- Identifies redundant activities and expenses

Limitations

- Time-intensive and resource demanding

- Requires significant financial expertise

- May create organizational resistance

- Can be impractical for some fixed cost categories

3. Activity-Based Budgeting (ABB)

Activity based budgeting focuses on the activities required to achieve business objectives. It identifies cost drivers and allocates resources based on the activities that generate value.

| Step | Description | Example |

| 1. Identify Activities | Determine all activities required to achieve objectives | Customer acquisition, product development, order fulfillment |

| 2. Determine Cost Drivers | Identify factors that influence the cost of each activity | Number of orders, production volume, customer interactions |

| 3. Calculate Activity Costs | Determine the cost per unit of each activity | $25 per customer service call, $150 per order processed |

| 4. Forecast Activity Levels | Project expected activity volumes for the budget period | 5,000 orders, 3,000 customer service calls |

| 5. Calculate Budget | Multiply activity costs by projected volumes | 5,000 orders × $150 = $750,000 for order processing |

4. Value Proposition Budgeting

Value proposition budgeting prioritizes spending based on the value each expense delivers to customers and the business. This approach focuses resources on activities that create the most significant competitive advantage.

The process involves evaluating each budget item against two key questions:

- How much value does this expenditure create for our customers?

- How much value does this expenditure create for our business?

Items that score highly on both dimensions receive priority funding, while low-value activities may be reduced or eliminated.

5. Flexible Budgeting

Flexible budgeting adapts to changing business conditions by adjusting budget allocations based on actual activity levels. This approach is particularly valuable for businesses with variable costs tied to production or sales volume.

Flexible Budget Formula: Fixed Costs + (Variable Cost Rate × Activity Level)

Example: If fixed costs are $500,000 and variable costs are $50 per unit, the flexible budget at 10,000 units would be:

$500,000 + ($50 × 10,000) = $1,000,000

Flexible budgeting is ideal for businesses with:

- Seasonal fluctuations in demand

- High proportion of variable costs

- Unpredictable market conditions

- Rapid growth or changing business models

Step-by-Step Guide to Creating a Financial Business Budget

Implementing effective financial business budgeting strategies requires a structured approach. Follow these ten steps to create a comprehensive budget that supports your business objectives.

1. Gather Historical Financial Data

Start by collecting financial data from previous periods, including income statements, balance sheets, and cash flow statements. This historical information provides a baseline for projections and helps identify trends and patterns.

Key data points to gather:

- Monthly revenue by product/service line

- Fixed and variable expense breakdowns

- Seasonal patterns in sales and expenses

- Year-over-year growth rates

- Profit margins by product/service

2. Define Budget Objectives and Timeline

Establish clear objectives for your budget that align with your business goals. Determine the budget period (typically 12 months) and set key milestones for the budgeting process.

| Budget Objective | Example Target | Measurement Method |

| Revenue Growth | 15% increase year-over-year | Monthly revenue reports vs. budget |

| Cost Reduction | Reduce operating expenses by 8% | Expense ratio analysis |

| Profit Margin Improvement | Increase gross margin from 35% to 40% | Quarterly margin analysis |

| Cash Flow Optimization | Maintain minimum $250,000 cash reserve | Weekly cash flow reporting |

3. Forecast Revenue

Develop detailed revenue projections based on historical performance, market trends, pricing strategies, and growth initiatives. Consider multiple scenarios (conservative, moderate, aggressive) to prepare for different outcomes.

Revenue Forecasting Methods:

- Historical Trending: Projecting future revenue based on historical growth rates

- Sales Pipeline Analysis: Forecasting based on current prospects and conversion rates

- Market-Based Forecasting: Projections based on market size and expected market share

- Bottom-Up Forecasting: Building projections from individual product/service line estimates

4. Estimate Fixed Costs

Identify and estimate all fixed costs expenses that remain relatively constant regardless of business activity levels. These typically include:

- Rent and facilities costs

- Salaries and benefits for permanent staff

- Insurance premiums

- Loan payments and interest

- Subscriptions and recurring services

- Base utilities and telecommunications

5. Project Variable Costs

Estimate variable costs that fluctuate with business activity. These costs typically scale with production volume or revenue and include:

- Raw materials and inventory

- Production labor

- Sales commissions

- Shipping and fulfillment

- Transaction fees

- Usage based services

6. Plan for Capital Expenditures

Identify necessary investments in long-term assets such as equipment, facilities, technology, or vehicles. Evaluate each capital expenditure based on:

- Expected return on investment (ROI)

- Impact on operational efficiency

- Strategic alignment with business goals

- Depreciation and tax implications

- Financing options and cash flow impact

7. Build Cash Flow Projections

Develop monthly cash flow projections that account for the timing of revenue collection and expense payments. Cash flow budgeting is critical for managing liquidity and avoiding cash shortages.

Cash Flow Warning Signs:

Watch for these indicators of potential cash flow problems:

- Consecutive months of negative cash flow

- Cash reserves falling below predetermined thresholds

- Increasing days sales outstanding (DSO)

- Seasonal gaps between major expenses and revenue

8. Create Departmental Budgets

Break down the master budget into departmental budgets that assign resources and responsibilities to specific business units. This creates accountability and allows for more detailed tracking.

Key departmental budgets typically include:

- Sales and marketing

- Operations and production

- Research and development

- Information technology

- Human resources

- Administration and finance

9. Review and Finalize

Conduct a comprehensive review of the budget with key stakeholders, including department heads, executives, and financial advisors. Ensure the budget:

- Aligns with strategic objectives

- Contains realistic and achievable targets

- Includes appropriate contingencies

- Balances growth investments with profitability

- Accounts for market conditions and risks

10. Implement Monitoring Systems

Establish systems and processes for tracking actual performance against budget projections. Regular monitoring allows for timely adjustments and helps maintain financial discipline.

Effective budget monitoring includes:

- Monthly variance analysis reports

- Quarterly budget reviews

- Key performance indicator (KPI) dashboards

- Cash flow tracking tools

- Regular stakeholder updates

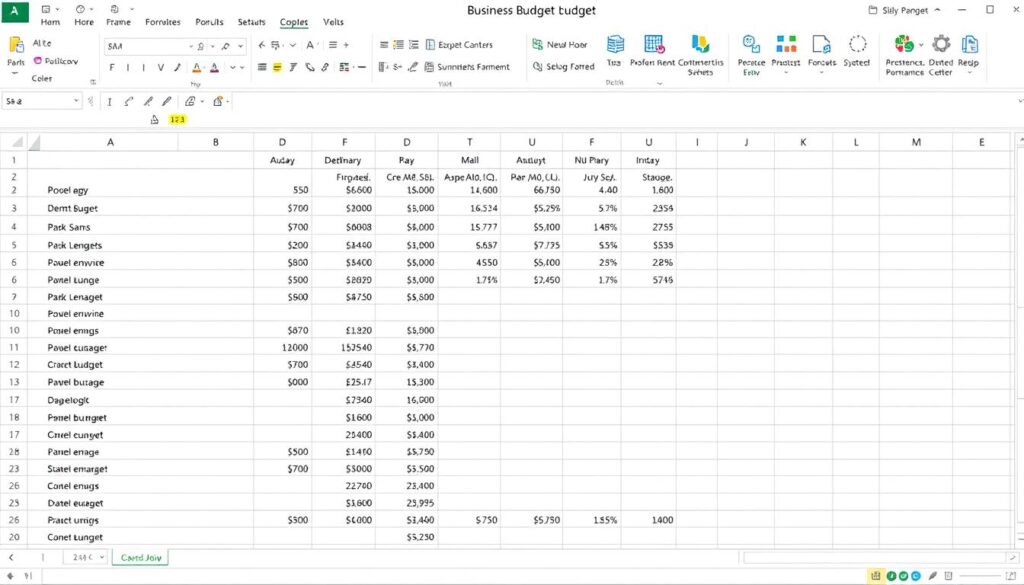

Financial Business Budgeting Templates You Can Use

Implementing financial business budgeting strategies is easier with the right templates. These Excel based tools provide structured frameworks for creating and managing your business budget.

Master Budget Template

A comprehensive template that integrates all budget components into a cohesive financial plan. Includes revenue projections, expense categories, cash flow forecasting, and variance analysis.

Cash Flow Budget Template

Specialized template for projecting and tracking cash inflows and outflows on a monthly basis. Helps identify potential liquidity issues and optimize working capital management.

Departmental Budget Template

Customizable templates for creating detailed departmental budgets. Includes expense categories, personnel planning, project budgeting, and performance tracking.

Zero-Based Budget Template

Structured template for implementing zero based budgeting methodology. Includes expense justification frameworks, cost-benefit analysis tools, and resource allocation planning.

Flexible Budget Template

Dynamic template that adjusts budget projections based on activity levels. Includes variable cost calculations, scenario analysis, and performance variance tracking.

Capital Expenditure Template

Specialized template for planning and evaluating capital investments. Includes ROI calculations, depreciation schedules, and funding source analysis.

Get All Financial Budgeting Templates

Access our complete library of Excel based financial business budgeting templates. Customizable, formula driven, and designed for business owners and financial professionals.

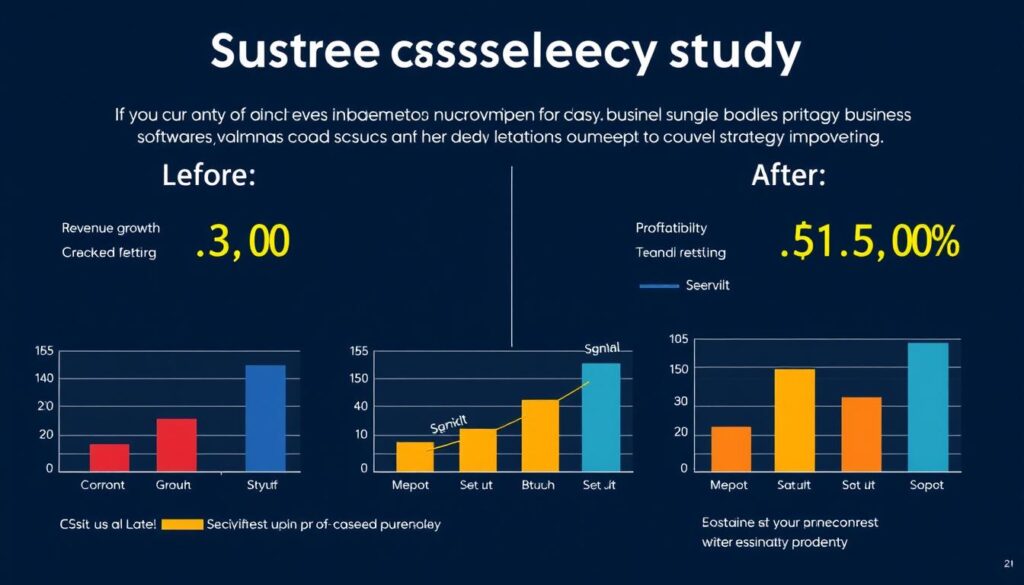

Financial Analysis Example: Budget Implementation Case Study

To illustrate effective financial business budgeting strategies in action, let’s examine how a mid sized software company transformed its financial performance through strategic budgeting.

Company Background

TechSolutions, Inc. is a B2B software provider with 85 employees and $12 million in annual revenue. Despite steady growth, the company struggled with inconsistent profitability, cash flow challenges, and difficulty funding new product development.

Budgeting Challenges

- Incremental budgeting approach that perpetuated inefficiencies

- Departmental silos creating redundant spending

- Lack of alignment between financial resources and strategic priorities

- Inadequate cash flow forecasting leading to liquidity issues

- Limited visibility into product-level profitability

Budget Transformation Strategy

Tech Solutions implemented a hybrid budgeting approach combining zero based budgeting for discretionary expenses with activity-based budgeting for core operations. Key elements included:

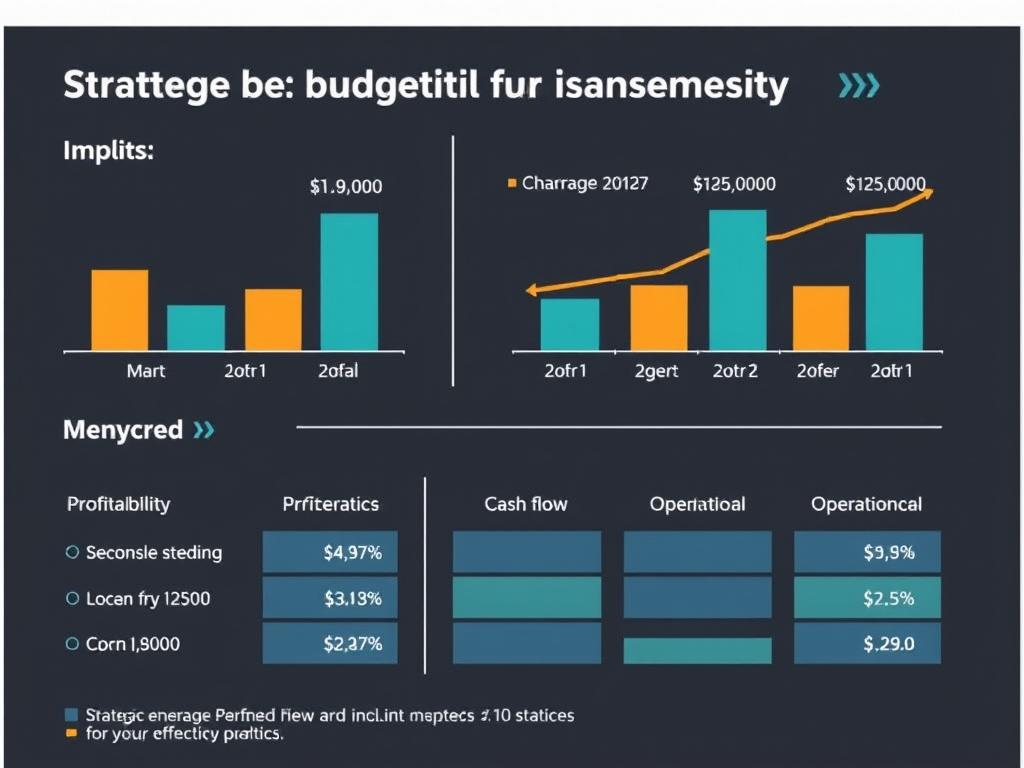

| Strategy Component | Implementation Approach | Results |

| Revenue Forecasting | Implemented bottom-up forecasting by product line with scenario analysis | Revenue forecasting accuracy improved from ±15% to ±5% |

| Cost Structure Analysis | Applied zero based budgeting to all discretionary spending categories | Identified 18% in potential cost savings without impacting operations |

| Resource Allocation | Aligned budget with strategic priorities using value proposition budgeting | Increased R&D funding by 25% while reducing overall expenses by 12% |

| Cash Flow Management | Implemented 13 week rolling cash flow forecasting | Eliminated cash shortages and reduced reliance on credit line by 60% |

| Performance Monitoring | Developed executive dashboard with weekly KPI updates | Reduced budget variance from ±12% to ±3% through proactive management |

Financial Impact Analysis

The implementation of strategic budgeting transformed TechSolutions’ financial performance across key metrics:

Key Lessons from the Case Study

- Hybrid approach: Combining multiple budgeting methodologies can address different aspects of financial management.

- Strategic alignment: Budgets must directly support business priorities to drive meaningful results.

- Data-driven decisions: Detailed financial analysis enables more informed resource allocation.

- Regular monitoring: Frequent performance tracking allows for timely adjustments and improved outcomes.

- Cross-functional collaboration: Involving all departments in the budgeting process improves buy in and implementation.

Best Tools for Financial Business Planning

Implementing effective financial business budgeting strategies requires the right tools. Modern software solutions can streamline the budgeting process, improve accuracy, and provide valuable insights for decision making.

Financial Planning Software

Enterprise Solutions

- Adaptive Planning – Comprehensive planning and forecasting

- Oracle EPM Cloud – Enterprise performance management

- SAP Analytics Cloud – Integrated planning and analytics

Ideal for large organizations with complex budgeting needs and multiple departments.

Mid-Market Solutions

- Prophix – Unified CPM software

- Vena Solutions – Excel-based planning platform

- Planful – Cloud financial planning

Suitable for growing businesses that need scalable budgeting capabilities.

Small Business Solutions

- PlanGuru – Forecasting and budgeting

- Float – Cash flow forecasting

- LivePlan – Business planning and budgeting

Cost-effective options for small businesses and startups with basic budgeting needs.

Specialized Budgeting Tools

Cash Flow Management

- Pulse – Visual cash flow forecasting

- Fluidly – AI-powered cash flow intelligence

- Agicap – Real-time cash flow management

These tools focus specifically on optimizing cash flow visibility and forecasting accuracy.

Expense Management

- Expensify – Automated expense tracking

- Divvy – Spend management platform

- Spendesk – All-in-one spend management

Streamline expense tracking and control to maintain budget discipline.

Integration Capabilities

The most effective budgeting tools integrate with your existing financial systems to provide a comprehensive view of your business finances.

- Accounting Software Integration – Sync with QuickBooks, Xero, or other accounting platforms

- ERP System Connectivity – Connect with enterprise resource planning systems

- CRM Integration – Link sales pipeline data to revenue forecasts

- Banking Connections – Real-time access to account balances and transactions

- API Flexibility – Custom integrations with other business systems

Find the Right Budgeting Tools for Your Business

Download our comprehensive guide to selecting and implementing financial planning software that meets your specific business needs.

How to Track Financial Business Performance

Implementing financial business budgeting strategies is just the beginning. Ongoing performance tracking is essential for maintaining financial discipline and achieving your business objectives.

Key Performance Indicators (KPIs)

Identify and track the financial metrics that matter most to your business. Effective KPIs should be:

- Aligned with strategic objectives

- Measurable and quantifiable

- Actionable and influenceable

- Timely and relevant

- Easily understood by stakeholders

| KPI Category | Key Metrics | Tracking Frequency |

| Profitability | Gross margin, EBITDA, net profit margin, return on investment | Monthly |

| Liquidity | Cash conversion cycle, current ratio, quick ratio, days sales outstanding | Weekly |

| Efficiency | Inventory turnover, asset turnover, operating expense ratio | Monthly |

| Growth | Revenue growth rate, customer acquisition cost, customer lifetime value | Monthly |

| Budget Performance | Budget variance, forecast accuracy, budget utilization rate | Monthly |

Variance Analysis

Regularly compare actual financial results with budget projections to identify variances and understand their causes. Effective variance analysis includes:

- Identify Variances – Calculate the difference between budgeted and actual figures

- Determine Materiality – Focus on significant variances that impact overall performance

- Analyze Root Causes – Investigate why variances occurred (internal factors, market conditions, etc.)

- Develop Action Plans – Create specific strategies to address negative variances

- Implement Controls – Establish mechanisms to prevent recurrence of unfavorable variances

Variance Analysis Formula: Variance = Actual Result – Budgeted Amount

Favorable variance: When actual revenue exceeds budget or actual expenses are less than budget

Unfavorable variance: When actual revenue falls short of budget or actual expenses exceed budget

Financial Reporting Cadence

Establish a regular schedule for financial reporting and performance reviews. A structured cadence ensures timely identification of issues and opportunities.

Weekly Reviews

- Cash position and short-term liquidity

- Sales pipeline and conversion metrics

- Critical expense categories

- Operational KPIs impacting finances

Monthly Reviews

- Complete P&L performance vs. budget

- Detailed variance analysis

- Cash flow statement review

- Department-level budget performance

Quarterly Reviews

- Strategic initiative progress

- Balance sheet analysis

- Budget reforecasting

- Market condition assessment

Performance Dashboards

Create visual dashboards that provide at-a-glance insights into financial performance. Effective dashboards should:

- Present key metrics in a visual format

- Highlight trends and patterns

- Enable drill-down into detailed data

- Update automatically with current information

- Be accessible to relevant stakeholders

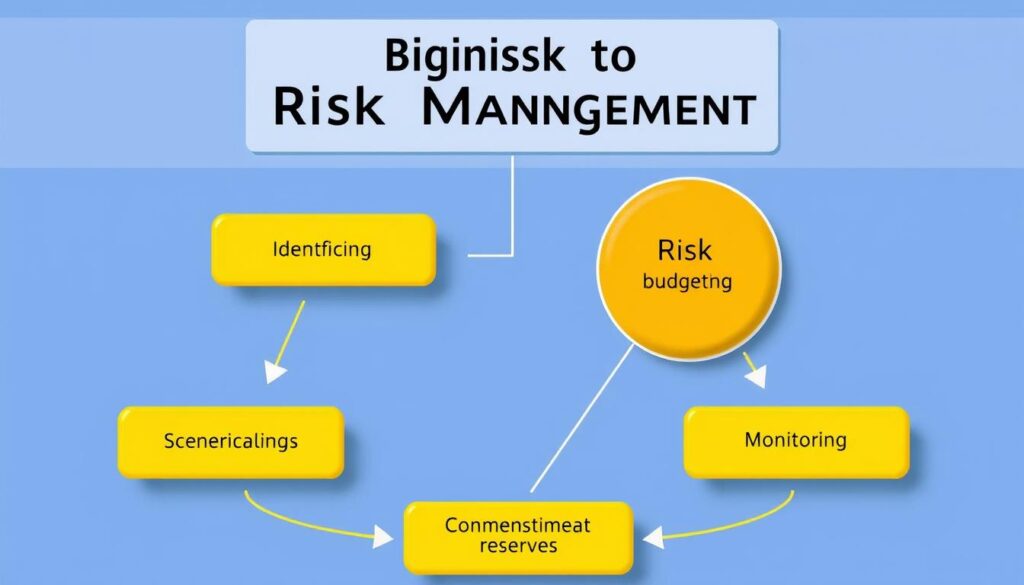

Managing Financial Business Risks Through Budgeting

Effective financial business budgeting strategies incorporate risk management to prepare for uncertainties and protect business stability. A well-designed budget serves as a risk mitigation tool by identifying potential challenges and establishing contingency plans.

Common Financial Risks

Internal Risks

- Cash Flow Shortages – Insufficient liquidity to meet obligations

- Cost Overruns – Expenses exceeding budgeted amounts

- Revenue Shortfalls – Sales falling below projections

- Operational Disruptions – Business interruptions affecting finances

- Fraud or Mismanagement – Financial losses due to internal issues

External Risks

- Market Volatility – Changing conditions affecting demand

- Regulatory Changes – New compliance requirements with financial impact

- Economic Downturns – Broader economic conditions affecting business

- Competitive Pressures – Market changes requiring financial adjustments

- Supply Chain Disruptions – Vendor issues affecting costs or operations

Risk Management Strategies in Budgeting

1. Scenario Planning

Develop multiple budget scenarios to prepare for different potential outcomes:

- Base Case – Most likely scenario based on reasonable assumptions

- Worst Case – Conservative scenario accounting for significant challenges

- Best Case – Optimistic scenario capturing upside potential

For each scenario, identify trigger points that would necessitate shifting from one plan to another.

2. Contingency Reserves

Allocate specific budget reserves to address unexpected events:

- General contingency fund (typically 5-10% of operating budget)

- Project-specific contingencies for major initiatives

- Cash reserves to maintain liquidity during disruptions

Contingency Reserve Calculation:

Contingency = Base Budget × Risk Factor

Where Risk Factor varies based on:

- Historical volatility (5-15%)

- Project complexity (10-25%)

- Market uncertainty (15-30%)

3. Sensitivity Analysis

Evaluate how changes in key variables affect overall financial performance:

- Identify critical variables (pricing, volume, costs, etc.)

- Model the impact of variable changes on profitability and cash flow

- Determine which variables have the greatest financial impact

- Focus risk management efforts on high-sensitivity areas

4. Hedging Strategies

Implement financial hedging to mitigate specific risks:

- Currency hedging for international operations

- Interest rate swaps for variable-rate debt

- Commodity futures for material cost stability

- Forward contracts for major purchases

5. Diversification

Reduce concentration risk through strategic diversification:

- Revenue streams across multiple products/services

- Customer base across different industries or regions

- Supplier relationships to prevent dependency

- Financing sources to maintain capital access

“The best financial business budgeting strategies don’t just plan for success—they prepare for challenges. A budget that incorporates risk management becomes a powerful tool for building business resilience.”

FAQs About Financial Business Budgeting Strategies

How do I create a financial business plan for a startup?

Creating a financial business plan for a startup involves several key steps:

- Research your market and competition thoroughly

- Develop realistic revenue projections based on market size and penetration

- Estimate startup costs including equipment, legal fees, and initial inventory

- Calculate operating expenses such as rent, salaries, and marketing

- Create cash flow projections for at least 12-24 months

- Determine your funding requirements and potential sources

- Establish key financial milestones and performance metrics

For startups, it’s particularly important to be conservative with revenue projections and generous with expense estimates. Include multiple scenarios and ensure you have sufficient runway to reach profitability.

What are the most important financial business ratios to track?

Key financial ratios that businesses should track include:

- Profitability Ratios: Gross profit margin, operating profit margin, net profit margin, return on assets (ROA), return on equity (ROE)

- Liquidity Ratios: Current ratio, quick ratio, cash ratio

- Efficiency Ratios: Inventory turnover, accounts receivable turnover, asset turnover

- Leverage Ratios: Debt-to-equity ratio, interest coverage ratio

- Growth Ratios: Revenue growth rate, earnings growth rate

The most relevant ratios vary by industry and business model. Compare your ratios to industry benchmarks and track trends over time to identify areas for improvement.

How often should I review and adjust my business budget?

Budget review frequency depends on your business size, industry volatility, and growth stage:

- Monthly Reviews: Compare actual performance to budget, identify variances, and make minor adjustments

- Quarterly Reviews: Conduct deeper analysis, update forecasts, and make more significant adjustments if needed

- Annual Planning: Complete comprehensive budget development for the upcoming year

Fast-growing businesses or those in volatile industries may benefit from more frequent reviews, potentially even weekly cash flow monitoring. The key is establishing a regular cadence that provides timely insights without creating excessive administrative burden.

What’s the difference between a budget and a forecast?

While related, budgets and forecasts serve different purposes:

- Budget: A financial plan that allocates resources based on expected income and expenses. Budgets are typically fixed for a period and serve as a target or benchmark for performance.

- Forecast: A prediction of actual financial outcomes based on current trends, market conditions, and business performance. Forecasts are regularly updated as new information becomes available.

Think of a budget as “what we want to happen” and a forecast as “what we think will happen.” Effective financial management requires both: budgets for planning and accountability, and forecasts for realistic expectations and decision-making.

How can I improve my financial business cash flow?

Improving cash flow requires strategies on both the inflow and outflow sides:

Accelerate Cash Inflows:

- Offer early payment discounts to customers

- Implement efficient invoicing and follow-up procedures

- Require deposits or milestone payments for large projects

- Consider factoring or accounts receivable financing

Manage Cash Outflows:

- Negotiate extended payment terms with suppliers

- Schedule payments strategically to maximize float

- Review recurring expenses for potential savings

- Lease equipment instead of purchasing when appropriate

Additionally, implement a rolling 13-week cash flow forecast to anticipate and prepare for potential shortfalls before they occur.

What are the best financial business tools for entrepreneurs?

Entrepreneurs should consider these essential financial tools:

- Accounting Software: QuickBooks, Xero, or FreshBooks for basic financial management

- Budgeting Tools: PlanGuru, LivePlan, or Float for financial planning

- Expense Management: Expensify, Zoho Expense, or Divvy for tracking spending

- Invoicing Solutions: Invoice2go, Wave, or Square Invoices for billing clients

- Financial Dashboard: Fathom, Klipfolio, or Databox for performance monitoring

The best tools depend on your business size, complexity, and specific needs. Start with core accounting functionality and add specialized tools as your business grows and your financial management needs become more sophisticated.

How do I build a financial business model?

Building a financial business model involves these key steps:

- Define Objectives: Clarify what questions the model needs to answer

- Gather Data: Collect historical financial data and market information

- Structure the Model: Create separate sections for revenue, expenses, capital, and financing

- Develop Assumptions: Document clear, defensible assumptions for key variables

- Build Projections: Create monthly or quarterly projections for 3-5 years

- Link Financial Statements: Connect income statement, balance sheet, and cash flow

- Add Scenario Analysis: Create toggles for different assumptions and scenarios

- Validate the Model: Test with historical data and review for logical consistency

Effective models balance detail with usability. Focus on the key drivers of your business and avoid excessive complexity that makes the model difficult to maintain and understand.

What financial business tax planning strategies should I consider?

Effective tax planning strategies for businesses include:

- Business Structure Optimization: Choose the right entity type (LLC, S-Corp, C-Corp) for tax advantages

- Timing of Income and Expenses: Accelerate deductions and defer income when beneficial

- Retirement Plan Contributions: Establish SEP IRAs, 401(k)s, or defined benefit plans

- Equipment Purchases: Leverage Section 179 deductions or bonus depreciation

- Tax Credits: Identify applicable credits for R&D, energy efficiency, or hiring

- Estimated Tax Payments: Manage cash flow with accurate quarterly payments

Always work with a qualified tax professional to ensure strategies are appropriate for your specific situation and compliant with current tax laws. Tax planning should be integrated into your overall financial business budgeting strategy.

How can I automate financial business processes?

Automating financial processes can improve accuracy, efficiency, and insights:

Key Automation Opportunities:

- Accounts Payable: Automated invoice processing, approval workflows, and payment execution

- Accounts Receivable: Automated invoicing, payment reminders, and reconciliation

- Expense Management: Mobile receipt capture, automated categorization, and policy enforcement

- Financial Reporting: Scheduled report generation and distribution

- Data Integration: Automated data flows between systems (accounting, CRM, ERP)

Implementation Approach:

- Identify manual processes consuming significant time

- Evaluate potential automation solutions

- Start with high-impact, low-complexity processes

- Implement, test, and refine automation workflows

- Measure time savings and error reduction

Focus on creating an integrated financial technology stack where data flows seamlessly between systems, minimizing manual intervention and providing real-time insights.

What are the best financial business reporting practices?

Effective financial reporting practices include:

- Consistency: Use standardized formats and calculation methodologies

- Timeliness: Deliver reports promptly after period close

- Relevance: Customize reports for different stakeholders’ needs

- Accuracy: Implement review processes to ensure data quality

- Context: Include comparisons to budget, prior periods, and benchmarks

- Visualization: Use charts and graphs to highlight key trends

- Commentary: Provide narrative explanations of significant variances

- Forward-Looking: Include updated forecasts alongside historical results

Core financial reports should include income statement, balance sheet, cash flow statement, budget variance analysis, and key performance indicators. Supplement these with specialized reports addressing specific business challenges or opportunities.

Conclusion: Implementing Effective Financial Business Budgeting Strategies

Mastering financial business budgeting strategies is a journey that evolves with your organization. The most successful businesses view budgeting not as a periodic administrative exercise but as an ongoing strategic process that drives decision-making and performance.

By implementing the frameworks, methods, and tools outlined in this guide, you can transform your approach to financial planning and create a stronger foundation for sustainable growth. Remember that effective budgeting balances structure with flexibility, discipline with adaptability, and short-term management with long-term vision.

Take Your Financial Budgeting to the Next Level

Download our complete financial business budgeting toolkit, including Excel templates, implementation guides, and performance tracking tools.