In this comprehensive guide, we’ll explore 19 actionable financial business tax planning tips that can help you minimize tax liabilities, maximize deductions, and optimize your overall financial position. From entity structure considerations to timing strategies and beyond, these approaches have been tested and proven by successful businesses across various sectors. Let’s dive into the strategies that could transform your approach to tax planning and potentially save you significant money in the process.

| Section | Description |

| Understanding Tax Planning Fundamentals | Core concepts and importance of strategic tax planning |

| Entity Structure Optimization | Choosing the right business structure for tax advantages |

| Maximizing Deductions & Credits | Identifying and leveraging available tax benefits |

| Timing Strategies | Strategic timing of income and expenses |

| Retirement & Benefit Planning | Tax-advantaged retirement and employee benefit options |

| Step-by-Step Implementation | Practical approach to implementing tax strategies |

| Financial Analysis Examples | Real-world scenarios demonstrating tax strategy impacts |

| Templates & Tools | Resources to support your tax planning efforts |

Understanding Financial Business Tax Planning Fundamentals

Before diving into specific strategies, it’s essential to understand what tax planning entails and why it’s crucial for financial business success. Tax planning is the analysis and arrangement of financial activities to minimize tax liability within the bounds of the law. Unlike tax evasion (which is illegal), tax planning is a legitimate practice that leverages available deductions, credits, and strategies to reduce your tax burden.

Why Tax Planning Matters for Financial Businesses

Financial businesses face unique tax challenges and opportunities due to the nature of their operations. Effective tax planning can help:

- Reduce overall tax liability through legitimate deductions and credits

- Improve cash flow by optimizing the timing of tax payments

- Support business growth by freeing up capital for reinvestment

- Minimize audit risk through proper documentation and compliance

- Create long-term wealth through tax-efficient investment strategies

For financial business owners, tax planning shouldn’t be a once-a-year activity but rather an ongoing process integrated into your overall financial business management strategy. By taking a proactive approach, you can make informed decisions throughout the year that positively impact your tax situation.

Entity Structure Optimization for Tax Efficiency

One of the most fundamental financial business tax planning tips involves selecting the optimal business structure. Your choice of entity can significantly impact how your business income is taxed, what deductions are available, and your overall tax liability.

Comparing Business Entity Types for Tax Advantages

| Entity Type | Tax Treatment | Advantages | Considerations |

| Sole Proprietorship | Pass-through taxation on personal return | Simplicity, low formation costs | Self-employment tax on all profits, personal liability |

| Partnership | Pass-through taxation to partners | Flexibility in profit/loss allocation | Self-employment tax for general partners |

| S Corporation | Pass-through taxation to shareholders | Potential SE tax savings on distributions | Reasonable salary requirements, ownership restrictions |

| C Corporation | Corporate tax rate (21%), plus dividend taxation | Lower corporate rate, fringe benefits | Potential double taxation, more complex |

| LLC | Flexible (default: pass-through) | Liability protection, tax flexibility | State fees, potential SE tax on all profits |

S Corporation Strategy for Self-Employment Tax Savings

For many financial business owners, the S Corporation structure offers significant tax advantages, particularly regarding self-employment taxes. Unlike sole proprietorships where all profits are subject to self-employment tax (15.3%), S Corporation owners can:

- Pay themselves a reasonable salary (subject to employment taxes)

- Take additional profits as distributions (not subject to self-employment tax)

Example: A financial consultant with $200,000 in profit could save approximately $11,475 in self-employment taxes by operating as an S Corporation with a reasonable salary of $100,000 and taking the remaining $100,000 as distributions.

When considering how to create a financial business plan with tax efficiency in mind, entity selection should be one of your first considerations. However, this decision should be made in consultation with a qualified tax professional who can evaluate your specific circumstances.

Maximizing Deductions and Credits for Financial Businesses

Identifying and properly documenting all eligible deductions is a cornerstone of effective financial business tax planning. Small business owners often miss valuable deductions simply because they’re unaware of their eligibility or fail to maintain proper documentation.

Common Deductions for Financial Businesses

Office and Equipment Expenses

- Home office deduction (if you qualify)

- Office rent or mortgage interest

- Office supplies and equipment

- Computer hardware and software

- Furniture and fixtures

Professional Development

- Continuing education courses

- Professional certifications

- Industry conferences

- Professional books and subscriptions

- Professional association memberships

Business Travel and Transportation

- Business travel expenses

- Vehicle expenses (actual or standard mileage)

- Client meeting expenses

- Parking and tolls for business purposes

Insurance and Financial Expenses

- Business insurance premiums

- Professional liability insurance

- Banking fees for business accounts

- Interest on business loans

- Credit card processing fees

Section 179 and Bonus Depreciation

Understanding depreciation options is crucial for financial business tax planning tips implementation. Section 179 allows businesses to deduct the full purchase price of qualifying equipment and software purchased during the tax year, rather than depreciating it over several years.

2024 Section 179 Limits: Businesses can deduct up to $1,250,000 in qualifying equipment purchases, with a phase-out threshold beginning at $3,130,000.

Additionally, bonus depreciation allows businesses to deduct a percentage of the cost of eligible new or used business equipment. The rates are phasing down:

- 2023: 80% bonus depreciation

- 2024: 60% bonus depreciation

- 2025: 40% bonus depreciation

Strategic timing of major equipment purchases can significantly impact your tax situation. For businesses expecting higher income in the current year, accelerating planned purchases may provide valuable tax savings.

Qualified Business Income Deduction (Section 199A)

Many financial businesses can benefit from the Qualified Business Income (QBI) deduction, which allows eligible taxpayers to deduct up to 20% of qualified business income from a pass-through entity. However, this deduction has limitations for specified service businesses, including financial services, based on taxable income thresholds.

For 2024, the income thresholds are:

- Single filers: Full deduction up to $191,950, phasing out completely at $241,950

- Married filing jointly: Full deduction up to $383,900, phasing out completely at $483,900

Strategic income timing and retirement plan contributions can help keep your taxable income below these thresholds to maximize the QBI deduction.

Strategic Timing for Income and Expenses

Effective financial business tax planning tips often involve strategic timing of income recognition and expense payments. For cash-basis taxpayers, this timing can significantly impact which tax year these items fall into.

Income Deferral Strategies

If you anticipate being in the same or lower tax bracket next year, consider these strategies to defer income:

- Delay sending invoices until late December for payments likely to arrive in January

- For service businesses, postpone completing projects until early next year when feasible

- Consider installment sales for major asset dispositions

- Explore opportunities to defer bonuses until the following year

Expense Acceleration Strategies

To maximize deductions in the current tax year:

- Prepay deductible expenses that will be due in early next year

- Purchase needed supplies and equipment before year-end

- Pay outstanding business bills before December 31

- Make charitable contributions from your business if it’s a pass-through entity

Important: These timing strategies are most effective for cash-basis taxpayers. Accrual-basis taxpayers have less flexibility since they must recognize income when earned and expenses when incurred, regardless of when cash changes hands.

Accounting Method Considerations

Your accounting method impacts how you track and report income and expenses. Most small businesses use the cash method, which offers more flexibility for tax planning. Under the Tax Cuts and Jobs Act, businesses with average annual gross receipts of $30 million or less (for the past three years) can use the cash method, even if they maintain inventory.

When developing financial business planning for beginners strategies, understanding the implications of your accounting method is crucial for effective tax planning.

Retirement and Benefit Planning for Tax Advantages

Implementing retirement plans and strategic benefit programs can provide significant tax advantages while helping you build wealth and attract talent. These strategies are essential components of comprehensive financial business tax planning tips.

Retirement Plan Options for Business Owners

| Plan Type | 2024 Contribution Limits | Key Advantages | Best For |

| Solo 401(k) | $23,000 employee + up to 25% of compensation as employer (total limit: $69,000) | High contribution limits, loan provisions | Self-employed with no employees |

| SEP IRA | Up to 25% of compensation or $69,000, whichever is less | Simplicity, low administration costs | Self-employed or small businesses |

| SIMPLE IRA | $16,000 employee + employer match | Easy setup, mandatory employer contributions | Businesses with up to 100 employees |

| Defined Benefit Plan | Based on actuarial calculations (can exceed $300,000) | Highest possible contributions | High-income owners nearing retirement |

Establishing a qualified retirement plan offers multiple tax benefits:

- Contributions are generally tax-deductible for the business

- Plan assets grow tax-deferred until withdrawal

- Potential tax credits for plan startup costs (up to $5,000 per year for three years)

- Reduced current-year taxable income through contributions

Tax-Advantaged Employee Benefits

Beyond retirement plans, offering certain employee benefits can provide tax advantages for both your business and your employees:

Health Benefits

- Health insurance premiums (fully deductible for the business)

- Health Savings Accounts (HSAs) contributions

- Health Reimbursement Arrangements (HRAs)

- Qualified Small Employer Health Reimbursement Arrangements (QSEHRAs)

Additional Benefits

- Education assistance (up to $5,250 tax-free annually)

- Dependent care assistance

- Group term life insurance

- Disability insurance

- Transportation benefits

These benefits can help you attract and retain talent while providing tax advantages for your business. When implementing financial business management tips, incorporating these benefit strategies can significantly enhance your overall tax position.

Step-by-Step Financial Business Tax Planning Strategy

Implementing effective tax planning requires a systematic approach. Follow these steps to develop and execute a comprehensive tax strategy for your financial business.

- Assess Your Current Tax SituationBegin by analyzing your current tax position, including projected income, existing deductions, and potential tax liabilities. Review prior year returns to identify patterns and opportunities.

- Identify Applicable Tax StrategiesBased on your business structure, income level, and goals, determine which tax strategies are most relevant. Consider both immediate tax-saving opportunities and long-term planning strategies.

- Evaluate Entity StructureReview your business entity type to ensure it’s optimal for your current situation. Consider consulting with a tax professional to determine if a different structure might offer advantages.

- Implement Retirement and Benefit PlansEstablish or optimize retirement plans and employee benefits that provide tax advantages while supporting your business goals.

- Develop a Tax CalendarCreate a schedule of important tax dates, including estimated tax payments, filing deadlines, and key decision points for implementing timing strategies.

- Establish Record-Keeping SystemsImplement robust systems for tracking deductible expenses, documenting business activities, and maintaining necessary tax records.

- Plan Major Purchases and InvestmentsStrategically time significant business expenditures to maximize available deductions and credits in the most advantageous tax year.

- Review and Adjust QuarterlyRegularly review your tax plan and make adjustments based on business performance, regulatory changes, and evolving goals.

Need Help Implementing Your Tax Strategy?

Our team of financial experts can help you develop and execute a customized tax plan tailored to your business needs.

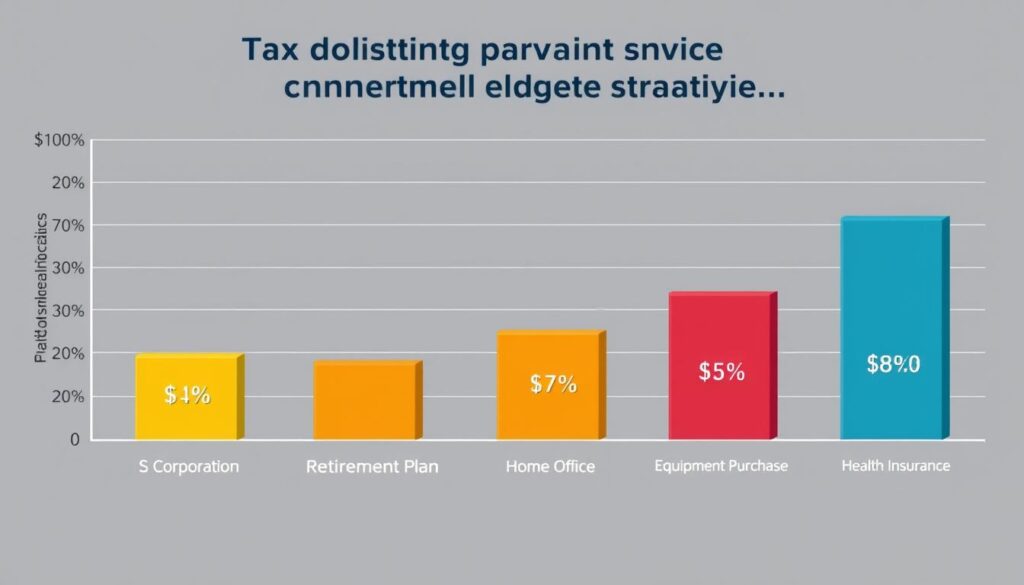

Financial Analysis Example: Tax Strategy Impact

To illustrate the potential impact of effective tax planning, let’s examine a case study of a financial consulting business with $500,000 in annual revenue.

Scenario: Financial Consulting Business

ABC Financial Consulting is a small firm with the following financial profile:

- Annual Revenue: $500,000

- Operating Expenses: $200,000

- Net Profit (before tax strategies): $300,000

- Owner: Single taxpayer in 32% marginal tax bracket

Tax Strategy Implementation

The owner implements several tax strategies:

| Strategy | Implementation | Tax Impact |

| S Corporation Election | Sets reasonable salary at $150,000 with $150,000 as distributions | Saves $22,950 in self-employment taxes |

| Retirement Plan | Establishes Solo 401(k) with $69,000 contribution | Reduces taxable income by $69,000, saving $22,080 in income tax |

| Home Office Deduction | Claims deduction for dedicated home office (300 sq ft) | Additional $3,000 deduction, saving $960 in income tax |

| Equipment Purchase | Purchases $25,000 in new equipment with Section 179 | Immediate $25,000 deduction, saving $8,000 in income tax |

| Health Insurance | Establishes QSEHRA for health insurance | $5,850 tax-free benefit, saving $1,872 in income tax |

Results Analysis

By implementing these strategies, the business owner achieves:

- Total tax savings: $55,862

- Effective tax rate reduction: from 32% to approximately 21%

- Additional retirement savings: $69,000

- Improved business infrastructure through strategic equipment investment

This example demonstrates how proper implementation of financial business tax planning tips can dramatically improve your after-tax financial position while building wealth through retirement savings and business investments.

“The difference between tax avoidance and tax evasion is the thickness of a prison wall.”

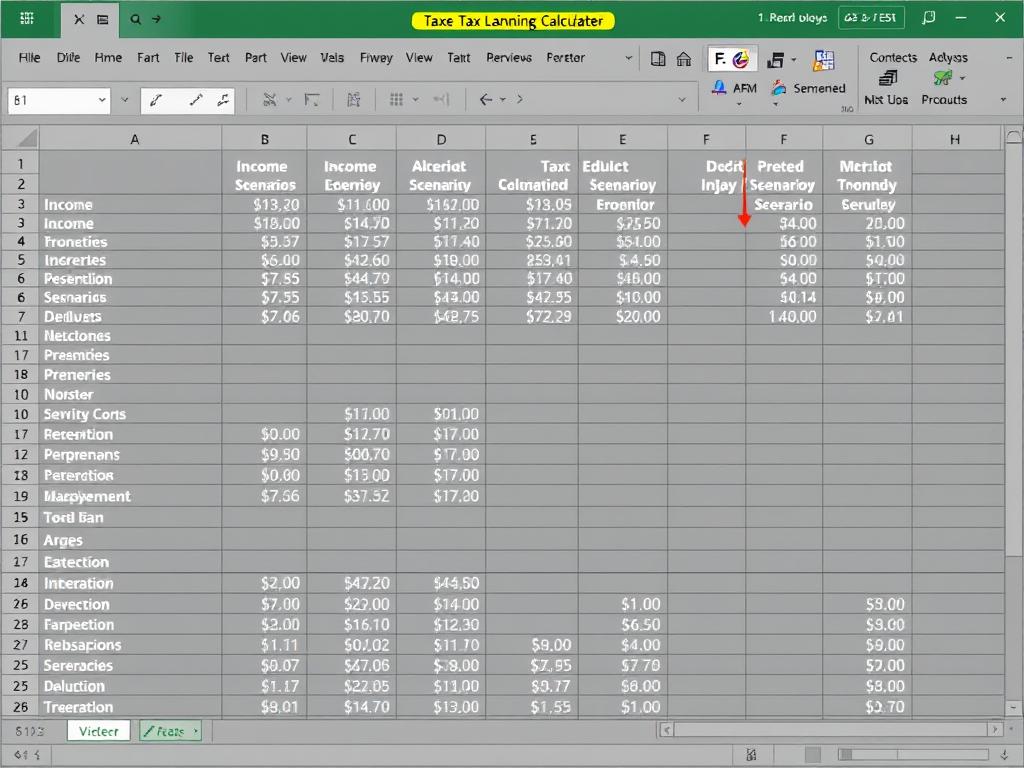

Templates and Tools for Financial Business Tax Planning

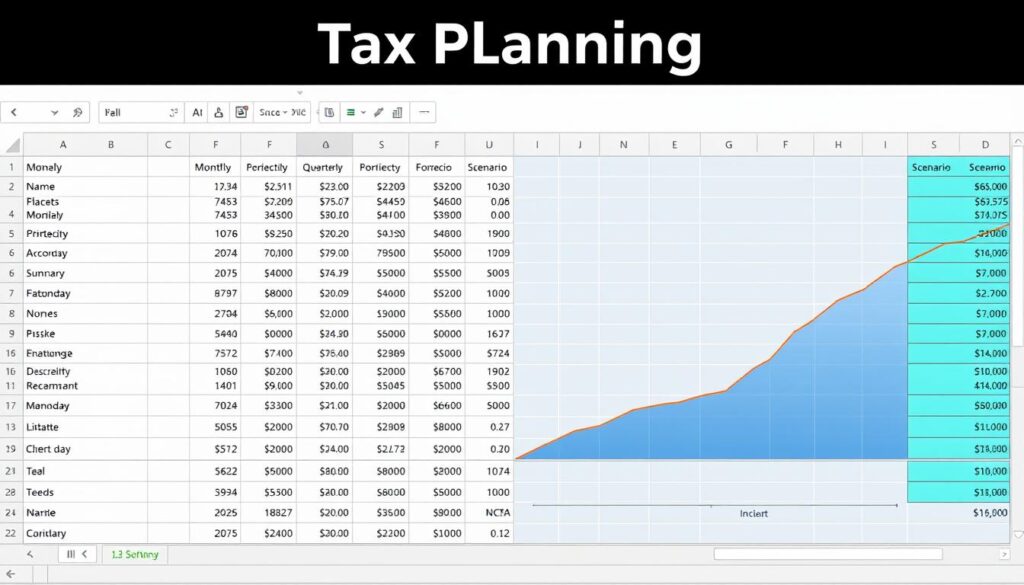

Effective tax planning requires proper tracking and analysis. The following Excel-based templates can help you implement best tools for financial business planning and maintain organized records for tax purposes.

Expense Tracking Template

Track all business expenses by category with automatic tax deduction eligibility indicators.

Tax Planning Calculator

Compare different tax scenarios and strategies with this comprehensive calculator.

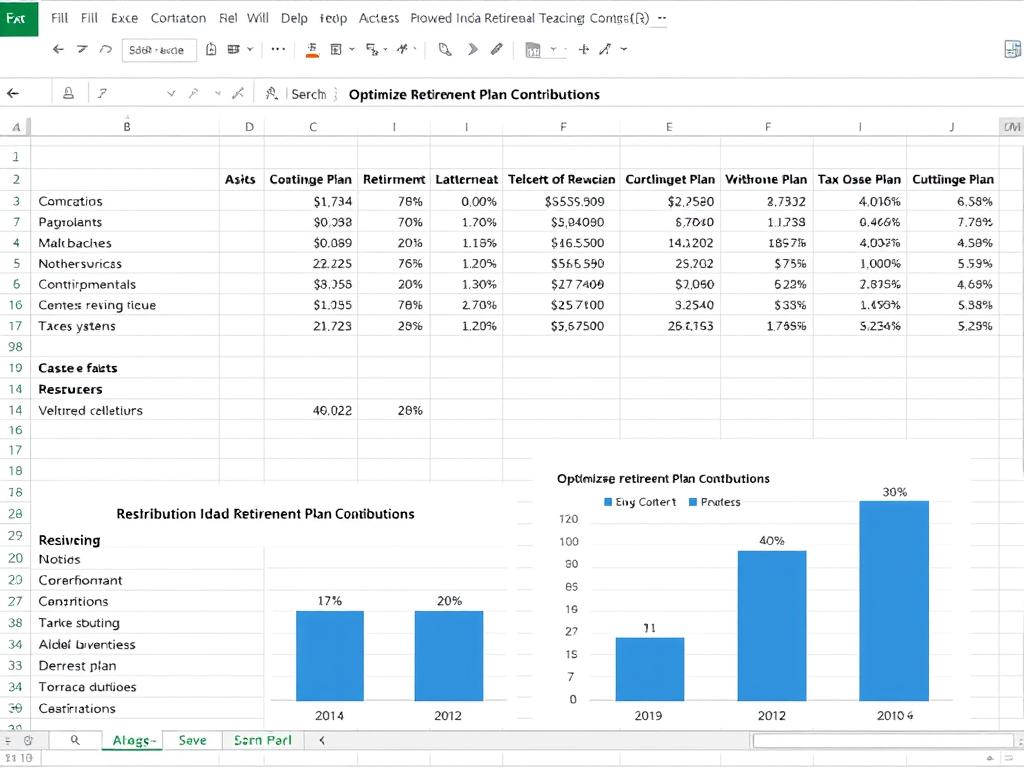

Retirement Contribution Optimizer

Determine optimal retirement contributions based on tax brackets and business income.

How to Track Financial Business Performance for Tax Optimization

Beyond basic templates, implementing comprehensive tracking systems is essential for identifying tax-saving opportunities throughout the year. Consider these approaches:

Regular Financial Reviews

- Monthly profit and loss analysis

- Quarterly tax projection updates

- Cash flow monitoring for timing strategies

- Budget-to-actual comparisons

Key Performance Indicators

- Effective tax rate tracking

- Expense-to-revenue ratios by category

- Profit margin analysis

- Return on investment for tax strategies

By leveraging these templates and implementing robust tracking systems, you can more effectively monitor your financial business performance and identify opportunities for tax optimization throughout the year.

Financial Business Forecasting Techniques for Tax Planning

Effective tax planning requires looking ahead to anticipate income, expenses, and potential tax liabilities. Implementing sound financial business forecasting techniques can help you make more informed tax decisions.

Income Projection Methods

Accurate income forecasting forms the foundation of tax planning. Consider these approaches:

- Historical Trending: Analyze past performance patterns and growth rates

- Pipeline Analysis: Project income based on current clients, contracts, and opportunities

- Scenario Planning: Develop best-case, worst-case, and most-likely scenarios

- Seasonal Adjustment: Account for cyclical business patterns in your projections

Tax Liability Forecasting

Once you’ve projected your income, you can estimate potential tax liabilities and identify planning opportunities:

- Calculate Projected Taxable IncomeStart with projected gross income and subtract estimated deductions and adjustments.

- Apply Current Tax RatesUse current tax brackets and rates to estimate your tax liability.

- Consider Alternative Minimum Tax (AMT)Determine if you might be subject to AMT based on your income and deductions.

- Factor in CreditsSubtract any tax credits you expect to qualify for from your projected liability.

- Estimate Quarterly PaymentsCalculate required estimated tax payments to avoid underpayment penalties.

Pro Tip: Update your tax forecasts quarterly to account for changing business conditions and new tax planning opportunities.

By implementing these financial business forecasting techniques, you can better anticipate your tax situation and take proactive steps to optimize your tax position throughout the year.

How to Automate Financial Business Processes for Tax Efficiency

Automating key financial processes can significantly improve tax compliance while reducing the time and effort required for tax preparation. Modern technology solutions make it easier than ever to streamline tax-related tasks.

Key Areas for Automation

Expense Tracking

Use apps that automatically capture receipts, categorize expenses, and track business mileage.

Income Recording

Implement systems that automatically record and categorize income from various sources.

Tax Document Management

Use digital solutions to organize and store tax-related documents securely.

Recommended Automation Tools

Consider these tools to help automate your financial business processes for improved tax efficiency:

| Category | Tool Options | Key Features |

| Accounting Software | QuickBooks Online, Xero, FreshBooks | Automated bank feeds, expense categorization, financial reporting |

| Expense Management | Expensify, Zoho Expense, Receipt Bank | Receipt scanning, automatic categorization, mileage tracking |

| Tax Preparation | TaxAct Business, H&R Block Premium, TurboTax Business | Form automation, deduction finders, integration with accounting software |

| Document Management | Dropbox Business, Google Drive, Microsoft OneDrive | Secure storage, document sharing, search functionality |

| Payroll Processing | Gusto, ADP, Paychex | Automated tax calculations, filing, and payments |

When selecting automation tools, look for solutions that integrate with each other to create a seamless financial ecosystem. This integration reduces manual data entry and minimizes the risk of errors that could lead to tax issues.

Integration Tip: Choose a core accounting system first, then select complementary tools that offer direct integration with your accounting platform.

By implementing these automation strategies, you can significantly improve your financial business efficiency while ensuring more accurate tax reporting and identifying additional tax-saving opportunities.

Financial Business Reporting Best Practices for Tax Compliance

Effective financial reporting is essential for both tax compliance and identifying tax planning opportunities. Implementing best practices in your reporting processes can help you maintain accurate records while providing insights for tax optimization.

Essential Financial Reports for Tax Planning

Regularly generate and review these key reports to support your tax planning efforts:

Income-Related Reports

- Profit and Loss Statement (monthly and year-to-date)

- Revenue by Client/Customer

- Revenue by Product/Service

- Accounts Receivable Aging

Expense-Related Reports

- Expense Summary by Category

- Fixed Asset Register

- Depreciation Schedule

- Accounts Payable Aging

Report Customization for Tax Insights

Standard financial reports often need customization to provide specific tax insights. Consider these modifications:

- Align expense categories with tax deduction categories

- Create separate tracking for expenses with different tax treatments

- Develop reports that compare actual results to tax projections

- Generate quarterly tax liability estimates based on current performance

Documentation Best Practices

Proper documentation is crucial for supporting tax positions and surviving potential audits:

- Implement a Consistent Filing SystemOrganize documents by tax year and category for easy retrieval.

- Document Business PurposeRecord the business purpose for expenses, especially for travel, meals, and entertainment.

- Maintain Supporting EvidenceKeep receipts, invoices, contracts, and other documentation that substantiates tax positions.

- Record ContemporaneouslyDocument information at the time of transactions rather than reconstructing later.

- Retain Records AppropriatelyKeep tax records for at least seven years, and some records (like asset purchases) for the life of the asset plus seven years.

Audit Protection: In case of an audit, well-organized and thorough documentation is your best defense. The burden of proof is on the taxpayer to substantiate deductions and credits claimed.

By implementing these financial business reporting best practices, you can ensure tax compliance while identifying opportunities for tax optimization throughout the year.

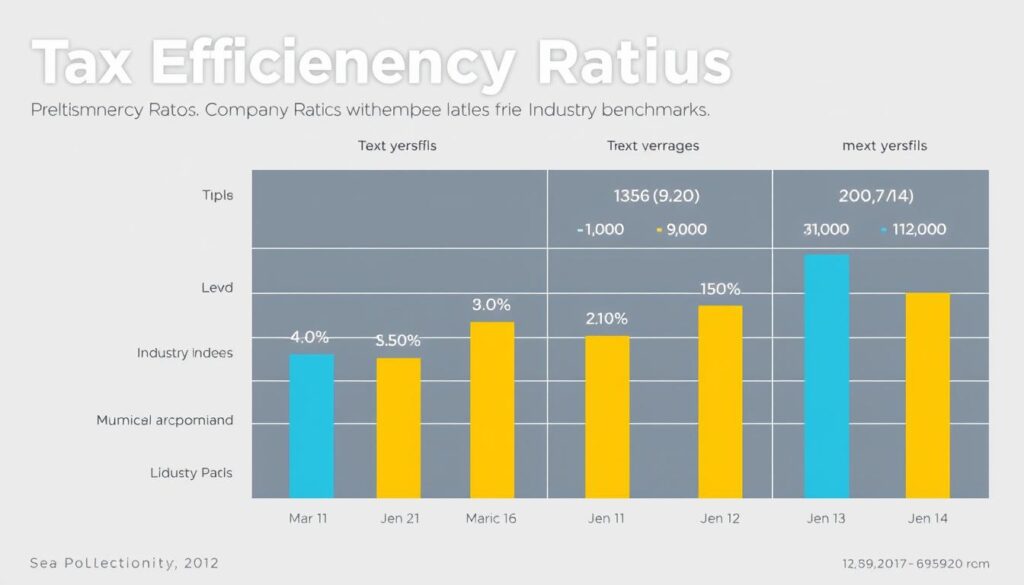

Financial Business Ratios Explained for Tax Optimization

Monitoring key financial ratios can provide valuable insights for tax planning and help you identify potential areas for tax optimization. Understanding these metrics allows you to make more informed business decisions with tax implications in mind.

Tax Efficiency Ratios

These ratios help measure how effectively your business is managing its tax burden:

| Ratio | Formula | Interpretation | Target Range |

| Effective Tax Rate | Total Tax Paid ÷ Pre-Tax Income | Percentage of income paid in taxes | Lower than statutory rate |

| Tax Expense Ratio | Tax Expense ÷ Revenue | Portion of revenue consumed by taxes | Industry dependent |

| Tax Savings Ratio | Tax Savings ÷ Tax Planning Costs | Return on tax planning investment | Greater than 3:1 |

| Deduction Utilization | Total Deductions ÷ Gross Income | Effectiveness in utilizing available deductions | Industry dependent |

Operational Ratios with Tax Implications

These standard business ratios have significant tax planning implications:

Profitability Ratios

- Gross Profit Margin: Indicates pricing strategy and cost structure

- Net Profit Margin: Shows overall profitability after all expenses

- Return on Assets: Measures efficiency of asset utilization

Liquidity Ratios

- Current Ratio: Indicates ability to pay short-term obligations

- Quick Ratio: Shows immediate liquidity for tax payments

- Cash Ratio: Measures ability to cover liabilities with cash

Using Ratios for Tax Planning

Here’s how to leverage these ratios in your financial business tax planning tips implementation:

- Benchmark Against Industry StandardsCompare your ratios to industry averages to identify potential areas for improvement.

- Track Trends Over TimeMonitor how your ratios change quarterly and annually to spot patterns and opportunities.

- Set Ratio TargetsEstablish target ranges for key ratios as part of your tax planning strategy.

- Use Ratios for Decision-MakingConsider the tax implications when making business decisions that will impact your financial ratios.

“What gets measured gets managed. Financial ratios provide the metrics needed to optimize your tax position.”

By incorporating these financial business ratios into your regular analysis, you can gain valuable insights for tax optimization while improving overall business performance.

How to Manage Financial Business Risks in Tax Planning

Effective tax planning must balance tax minimization with compliance and risk management. Understanding and mitigating potential risks is essential for implementing sustainable tax strategies.

Common Tax Planning Risks

Legitimate Tax Planning

- Using explicitly permitted deductions and credits

- Timing transactions based on tax considerations

- Choosing tax-advantaged investment vehicles

- Selecting optimal business entity structures

- Implementing qualified retirement plans

Aggressive Tax Positions

- Taking unsupported deductions

- Creating artificial transactions solely for tax benefits

- Misclassifying workers to avoid employment taxes

- Using multiple entities without business purpose

- Failing to report all income

Risk Mitigation Strategies

Implement these approaches to manage tax planning risks effectively:

- Maintain Proper DocumentationKeep thorough records supporting all tax positions, including business purpose for transactions and expenses.

- Stay Current on Tax LawRegularly review tax law changes that might impact your planning strategies.

- Seek Professional GuidanceConsult with qualified tax professionals before implementing significant tax strategies.

- Consider the Substance Over Form DoctrineEnsure transactions have legitimate business purpose beyond tax benefits.

- Implement Internal ControlsEstablish processes to verify accuracy of financial information used for tax reporting.

- Conduct Regular Tax Risk AssessmentsPeriodically review your tax positions to identify potential areas of concern.

Important: The line between tax avoidance (legal) and tax evasion (illegal) can sometimes be thin. When in doubt, consult with a qualified tax professional before implementing aggressive tax strategies.

By taking a balanced approach to tax planning that considers both potential savings and associated risks, you can develop a sustainable strategy that minimizes your tax burden while maintaining compliance with tax laws and regulations.

Frequently Asked Questions About Financial Business Tax Planning

What is the difference between tax planning and tax preparation?

Tax planning is a proactive, year-round strategy to minimize tax liability through legitimate methods like timing income recognition, maximizing deductions, and choosing optimal business structures. Tax preparation is the reactive process of completing and filing tax returns based on past transactions. Effective tax planning happens throughout the year and can significantly reduce your tax burden, while tax preparation simply reports what has already occurred.

When is the best time to implement tax planning strategies?

The best time to implement tax planning strategies is throughout the year, not just during tax season. Many effective strategies require action before year-end to impact the current tax year. For new businesses, tax planning should begin before you even form your entity. Established businesses should conduct quarterly tax planning reviews to assess current strategies and identify new opportunities. Year-end (October-December) is particularly important for implementing last-minute strategies before the tax year closes.

How can I determine if my business entity structure is optimal for tax purposes?

To determine if your business entity structure is optimal for tax purposes, consider these factors:

- Current and projected income levels

- Self-employment tax implications

- Need for liability protection

- Plans for distributing profits

- Retirement planning goals

- Exit strategy and succession planning

The optimal structure often changes as your business evolves. Consult with a tax professional who can analyze your specific situation and recommend the most advantageous structure based on your current circumstances and future goals.

What documentation should I maintain to support business tax deductions?

To support business tax deductions, maintain these essential documents:

- Receipts for all business purchases (digital or physical)

- Bank and credit card statements

- Mileage logs for business travel

- Home office measurements and expenses

- Entertainment and meal receipts with notes on business purpose

- Asset purchase documentation and depreciation records

- Business travel itineraries and expenses

- Documentation of business purpose for expenses

The IRS requires that you keep tax records for at least three years from the date you filed your return, though keeping them for seven years is recommended, especially for significant deductions.

How can I reduce self-employment taxes as a business owner?

To reduce self-employment taxes as a business owner, consider these strategies:

- S Corporation Election: If you operate as an LLC or partnership, electing S Corporation status allows you to pay yourself a reasonable salary (subject to employment taxes) and take additional profits as distributions (not subject to self-employment tax).

- Retirement Plan Contributions: Contributions to qualified retirement plans reduce your self-employment income and thus your self-employment tax.

- Health Insurance Premiums: Self-employed individuals can deduct health insurance premiums, reducing taxable income.

- Family Employment: Hiring family members can shift income and potentially reduce overall self-employment taxes.

Always ensure your strategies comply with IRS guidelines, particularly regarding “reasonable compensation” requirements for S Corporation owners.

What are the most commonly overlooked tax deductions for financial businesses?

Financial businesses frequently overlook these valuable tax deductions:

- Professional Development: Continuing education, certifications, and industry conferences

- Software Subscriptions: Financial tools, CRM systems, and productivity applications

- Home Office Deduction: When a portion of your home is used exclusively for business

- Banking Fees: Business account maintenance fees and transaction costs

- Professional Memberships: Industry associations and networking groups

- Business Insurance: Liability, E&O, and other business-specific policies

- Retirement Plan Administration: Fees for maintaining qualified plans

- Client Gifts: Up to per recipient annually

- Bad Debts: Uncollectible accounts from services provided

- Business Portion of Phone/Internet: The percentage used for business purposes

Tracking these expenses throughout the year can lead to significant tax savings at filing time.

How do retirement plans factor into tax planning for business owners?

Retirement plans are powerful tax planning tools for business owners because they offer multiple benefits:

- Current Year Tax Deductions: Contributions to qualified plans are generally tax-deductible, reducing current taxable income.

- Tax-Deferred Growth: Investment earnings grow tax-deferred until withdrawal.

- Self-Employment Tax Reduction: Contributions reduce self-employment income and associated taxes.

- Wealth Building: While minimizing taxes, you’re simultaneously building retirement assets.

- Employee Retention: Offering retirement benefits helps attract and retain talent.

- Tax Credits: Small businesses may qualify for tax credits for starting retirement plans.

The optimal retirement plan depends on your business structure, income level, number of employees, and long-term goals. Options include Solo 401(k), SEP IRA, SIMPLE IRA, and defined benefit plans, each with different contribution limits and requirements.

What are the potential penalties for aggressive tax positions?

Taking aggressive tax positions can result in several penalties if the IRS challenges and disallows them:

- Accuracy-Related Penalty: 20% of the underpayment for negligence or substantial understatement of tax.

- Civil Fraud Penalty: 75% of the underpayment attributable to fraud.

- Failure to Pay Penalty: 0.5% of unpaid tax per month, up to 25%.

- Interest Charges: Accrues on unpaid taxes from the original due date.

- Preparer Penalties: Tax preparers may also face penalties for endorsing aggressive positions.

In extreme cases, criminal charges could apply for willful tax evasion. Beyond financial penalties, aggressive positions may trigger audits that consume time and resources. Always ensure tax strategies have substantial business purpose and economic substance beyond tax benefits.

How can I effectively time income and expenses for tax advantages?

Effective timing of income and expenses can significantly impact your tax situation. Consider these strategies:

For Cash-Basis Taxpayers:

- Income Deferral: Delay sending invoices until late December for January payment.

- Income Acceleration: Send invoices earlier if you expect higher tax rates next year.

- Expense Acceleration: Purchase needed supplies and pay bills before year-end.

- Expense Deferral: Delay payments until January if you expect higher income next year.

For All Taxpayers:

- Asset Purchases: Time major purchases to maximize Section 179 or bonus depreciation.

- Retirement Contributions: Maximize contributions based on projected income.

- Loss Harvesting: Sell underperforming investments to offset capital gains.

The optimal strategy depends on whether you expect to be in a higher or lower tax bracket in the coming year. Always ensure business decisions have legitimate purposes beyond tax considerations.

How often should I review and update my tax planning strategy?

Your tax planning strategy should be reviewed and potentially updated at these key intervals:

- Quarterly: Review year-to-date performance and adjust strategies as needed.

- Annually: Conduct a comprehensive review before year-end to implement last-minute strategies.

- After Tax Filing: Evaluate the effectiveness of your previous year’s strategies.

- When Tax Laws Change: Reassess your approach when significant tax legislation is enacted.

- During Business Transitions: Review when experiencing growth, contraction, or structural changes.

- Personal Life Changes: Update when experiencing marriage, divorce, children, or approaching retirement.

Regular reviews ensure your tax strategy remains aligned with your business goals and takes advantage of all available opportunities while adapting to changing circumstances and regulations.

Conclusion: Implementing Your Financial Business Tax Planning Strategy

Effective tax planning is not a one-time event but an ongoing process that requires attention throughout the year. By implementing the financial business tax planning tips outlined in this guide, you can significantly reduce your tax burden while ensuring compliance with tax regulations.

Remember that the most successful tax strategies are those that align with your overall business goals and financial objectives. While tax savings are important, they should support—not drive—your core business decisions.

As tax laws continue to evolve, staying informed and working with qualified tax professionals becomes increasingly important. Consider partnering with a tax advisor who understands your industry and can provide personalized guidance for your specific situation.

Ready to Optimize Your Tax Strategy?

Our team of financial experts can help you develop and implement a comprehensive tax plan tailored to your business needs. Take the first step toward significant tax savings today.

By taking a proactive approach to tax planning, you can transform what many business owners view as a burden into a strategic advantage that contributes to your long-term financial success.